Finance costs

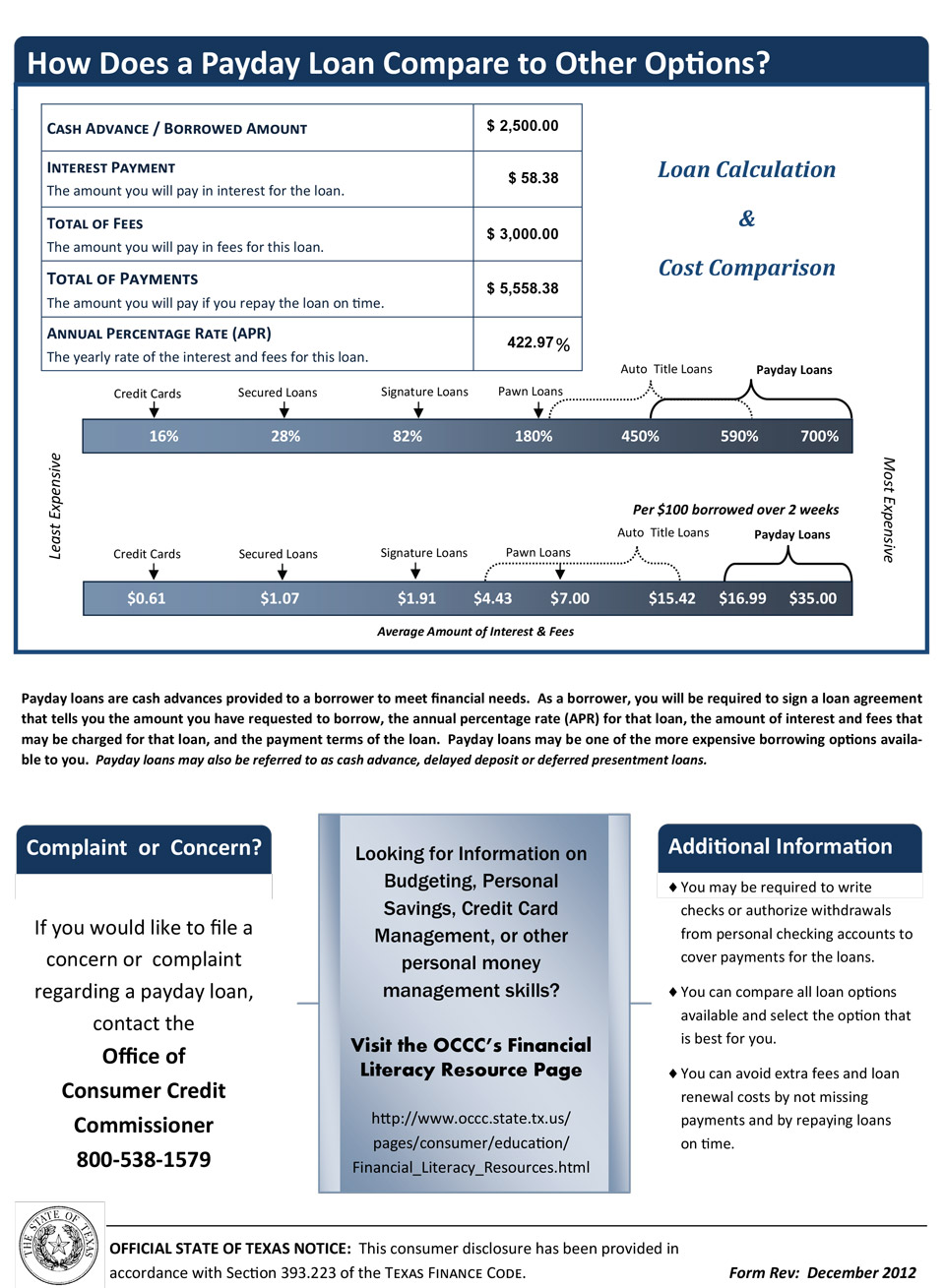

It is not unusual of these forms of loans to possess interest levels over 200% if not 400%. You could expect you’ll spend about $30 for virtually any $100 you finance. These loans have actually excessively high expenses and in the event that you don’t have work to cover the loan right back in the first couple of days of using it down, those expenses will compare quickly.

ACH direct debit

One other issue could be the ACH debit that is direct a lot of these loan systems utilize for re payment. They hook up to your banking account to direct deposit the funds you get, then they direct debit the re payments through the exact same account. This might produce difficulties with your money. ACH re re payments may be difficult to stop & most AFS loan providers allow it to be very difficult, if you don’t impossible, to cease those re re payments. They’ll empty your money and compare NSF and overdraft charges.

When you’re unemployed, you don’t have the means to spend back once again these loans, so that it’s far better avoid them. Perhaps you are in a position to pay a certain bill on time, but you’ll hurt your money within the run that is long. And don’t be tricked! a short-term installment loan or payday loan or fast loan are typical simply alternate names for payday advances. No real matter what it is called, it is detrimental to your money!

Don’t have lured into funding alternatives that will make your circumstances worse. Get a totally free assessment to locate real assistance today.

Once you can’t manage to make your repayments, then you begin interested in options – consolidation, credit counseling, debt negotiation, and bankruptcy. Nonetheless, the reality of this matter is the fact that then most of those options won’t work for you if you have absolutely no income to make payments or cover fees. You’ll need certainly to get a work first, then concentrate on getting back into security with regards to the debt.

Debt consolidating

Debt consolidation reduction rolls multiple debts into just one payment per month that’s usually less than what you’re having to pay now. Nonetheless, to have a debt consolidation reduction loans, you’ll need certainly to offer verification of one’s employment. Because you can’t do this when you’re unemployed, loan providers are not likely to increase loans for you.

Financial obligation management system

You can often go through a credit counseling agency to enroll in a debt management program if you need to lower your monthly payments. This will be a payment arrange for personal credit card debt that rolls your entire bills into one payment per month. That re  payment is usually less than just just exactly what you’re having to pay now, & most creditors will accept reduce or expel interest charges aswell.

payment is usually less than just just exactly what you’re having to pay now, & most creditors will accept reduce or expel interest charges aswell.

But, you nonetheless still need to truly have the method of making the re re payment on a monthly basis. Therefore, until you secure new employment if you can’t make the monthly payment every month, this option won’t work.

Financial obligation administration programs have a tendency to work well once you get yourself a new work and have to stop any harm you may possibly have currently caused your credit. When you return to an income that is stable one of the very very first telephone phone calls ought to be to a credit guidance agency.

Debt negotiation system

Debt relief programs are an alternative choice you may be turning over. The commercials claim to help you get out of financial obligation for “pennies regarding the buck.” That sounds great whenever you just have actually cents to spare with no brand new bucks coming in. Nevertheless, the reality is that debt consolidation will pay away about 48per cent of just what a borrower owes, an average of. Therefore, when you could possibly get away from financial obligation at a lower price, you won’t get free from it for absolutely nothing.

What’s more, debt settlement programs that are most work by requiring you to definitely spend a monthly put aside. It’s basically a reduced payment that is monthly must make to come up with the funds had a need to make settlement provides. You can’t make settlement offers if you have no money. Therefore, also debt consolidation often won’t work while you’re unemployed.

Debt negotiation additionally has a tendency to work most readily useful once you obtain a job that is new. If you only want to get free from financial obligation quickly and don’t care about the credit harm, settlement has a tendency to provide the quickest, cheapest exit versus other solutions. It is additionally perfect for debts which have been charged off and sold to a collector that is third-party.

Bankruptcy

Another solution people think it is simple to make use of whenever you’re broke is bankruptcy. However, bankruptcy costs additional money than you might think. A Chapter 7 filing costs $335 and Chapter 13 costs $310. There could be extra costs that the bankruptcy trustee may charge whenever you file also. It’s also possible to need certainly to spend a charge for pre-bankruptcy credit counseling, which varies from $50-$100, with respect to the continuing state in your geographical area.

Those will be the costs pay that is you’d spending any costs up to a bankruptcy attorney to register. In some instances of extreme hardship that is financial you might be in a position to waive the costs or ask to pay for it back in installments. You will have to make an application for the charge waiver in the right time whenever you file.

As soon as you secure brand brand new work and begin to get constant paychecks once again, you ought to make an idea to regain economic security. These pointers might help:

- Don’t restore costs you cut from your own spending plan until you’re in the clear with all the financial obligation you produced throughout your jobless duration. Remain on a decent spending plan until you’re really back into keeping security, then you can certainly begin to reintroduce those costs which you cut.

- Assess where all of your financial situation appears:

- Present

- Behind

- Charged off / default

- Pay attention to maintaining the debts that are current on some time bringing those who are somewhat past-due present.

- In case a financial obligation is past-due, phone the creditor which will make re payment plans to catch up. You might be in a position to put up one thing called a good work out arrangement, where in fact the creditor can help you create catchup re re re payments and could consent to freeze interest costs in order to spend the debt off faster. Your account will be frozen during generally this time around.

- For debts which have recently been offered to enthusiasts, debt consolidation is actually the most suitable choice to utilize. You provide a share regarding the stability you borrowed from as well as in trade, the collector agrees to discharge the balance that is remaining.